VCs explain why most consumer AI startups still struggle to achieve long-term success.

VCs discussing why consumer AI startups struggle to achieve long-term success.Three years after the generative AI boom began, venture

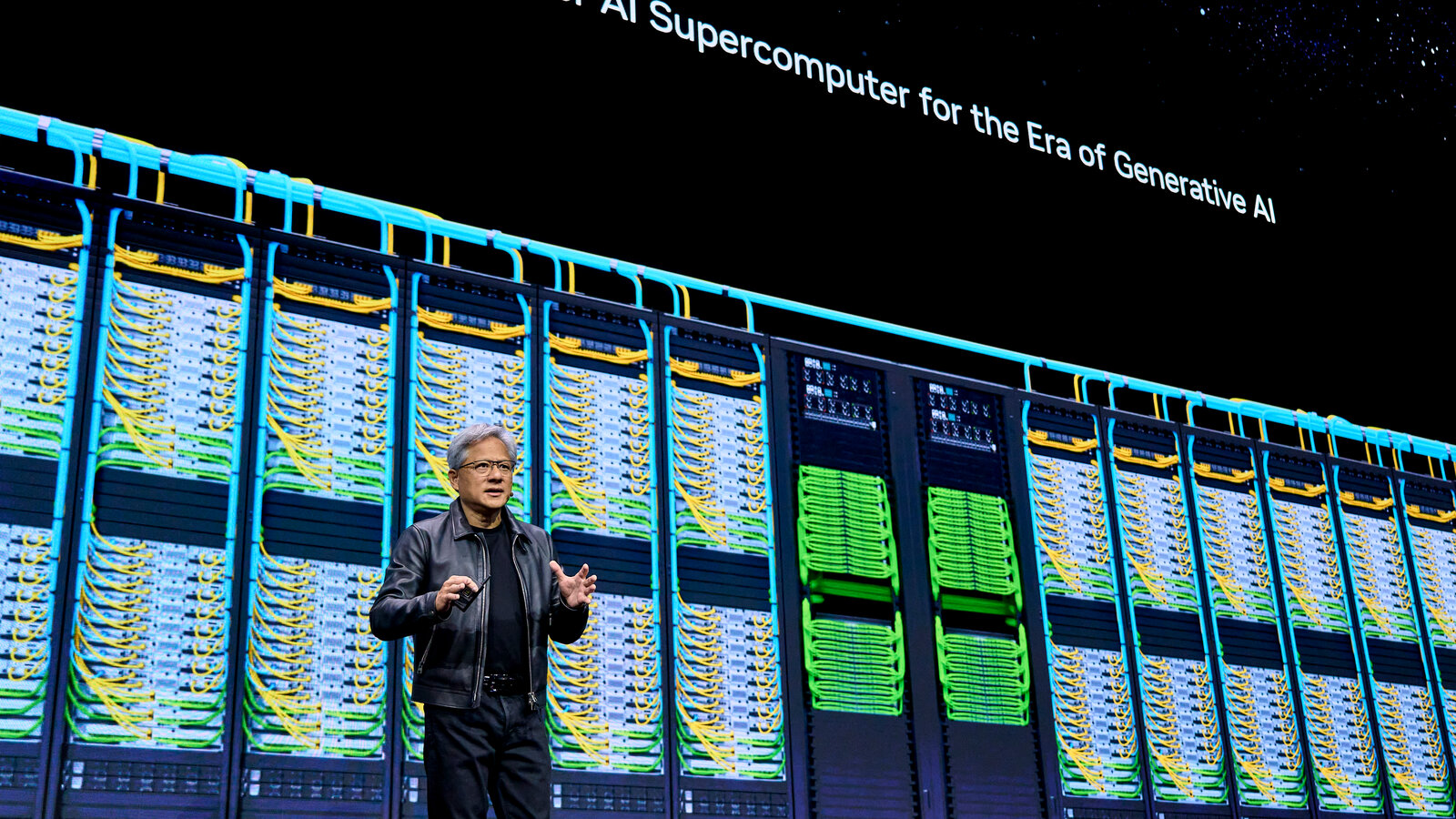

VCs discussing why consumer AI startups struggle to achieve long-term success.Three years after the generative AI boom began, venture capitalists are warning that consumer AI startups struggle with a fundamental challenge: downloads are easy, but building lasting user habits is extremely difficult. App intelligence firms like data.ai and Sensor Tower have documented a troubling pattern—huge initial spikes for AI photo filters, chat apps, and content tools followed by steep month-two drop-offs, with day-30 retention for generic AI chat experiences typically falling into single digits. Chi-Hua Chien, co-founder and managing partner at Goodwater Capital, explained at TechCrunch’s StrictlyVC event that many early AI applications around video, audio, and photo were initially exciting, but when tools like Sora emerged and Chinese companies open-sourced their video models, those opportunities disappeared. He compared these applications to the simple flashlight app that was once a popular iPhone download but was quickly integrated into iOS itself, arguing that AI platforms need time to solidify before game-changing consumer apps can emerge.

VCs point to several structural problems preventing consumer AI from achieving staying power, starting with the smartphone itself being a poor canvas for AI-native experiences because it’s not ambient, doesn’t see much of a user’s real world, and requires frequent taps and swipes that break AI’s promise to help without users even noticing. Chien suggested that a device people pick up 500 times daily but only sees 3 to 5 percent of what they see is unlikely to introduce use cases that take full advantage of AI’s capabilities. When AI that’s good enough comes preinstalled and free, startups need to deliver a genuine order-of-magnitude leap in value or significantly better workflow to lure users from defaults, especially when incumbents can announce new features to billions overnight. VCs have been particularly skeptical about AI-native social networks, with Chien stating that bot-filled networks turn social into a single-player game, creating hollow simulacrums of social products’ true purpose—connecting with other humans.

Despite the caution, investors remain optimistic about specific consumer AI categories with enduring, high-frequency needs: personal finance copilots that learn users’ cash flow and risk preferences, health and wellness companions rooted in clinician-reviewed protocols, and education tutors that develop long-term mastery with parent and teacher dashboards. These successful categories share common traits: proprietary data, increased personalization over time, and obvious willingness to pay. With model quality converging and APIs maturing, the competitive edge returns to product craft—latency beneath a second, genuinely helpful memory, privacy-respecting guardrails, and ambient rather than chat-bound experiences. However, not every promising consumer AI product will depend on a new device, with Chien suggesting personal AI financial advisers and Weil anticipating personalized always-on tutors as examples that could succeed on smartphones. The key to achieving consumer AI staying power lies not in demo-friendly features but in thoughtful product design that transforms novelty into daily ritual.