The AI boom is bringing huge profits to Nvidia.

Nvidia’s market capitalization surged from $1.2 trillion at the end of 2023 to $3.28 trillion by the end of

Nvidia’s market capitalization surged from $1.2 trillion at the end of 2023 to $3.28 trillion by the end of 2024, making it the biggest global gainer in market value during that period. This remarkable growth has been driven by overwhelming demand for the company’s artificial intelligence chips, which power everything from large language models like ChatGPT to autonomous vehicles and advanced computing systems. The company reported record quarterly revenue of $44.1 billion for Q1 of fiscal 2026, representing a 69% increase from the same period the previous year.

The company’s data center division has become its primary revenue engine, with sales reaching extraordinary levels. Data center chip sales expanded 66% year-over-year to $51.2 billion in the third quarter, demonstrating Nvidia’s dominance in the AI infrastructure market. Tech giants including Microsoft, Google, Meta, and Amazon have significantly increased their AI spending, with much of that investment flowing directly to Nvidia for its advanced processing chips. The company has maintained an impressive gross profit margin in the mid-70s percentage range despite rising input costs.

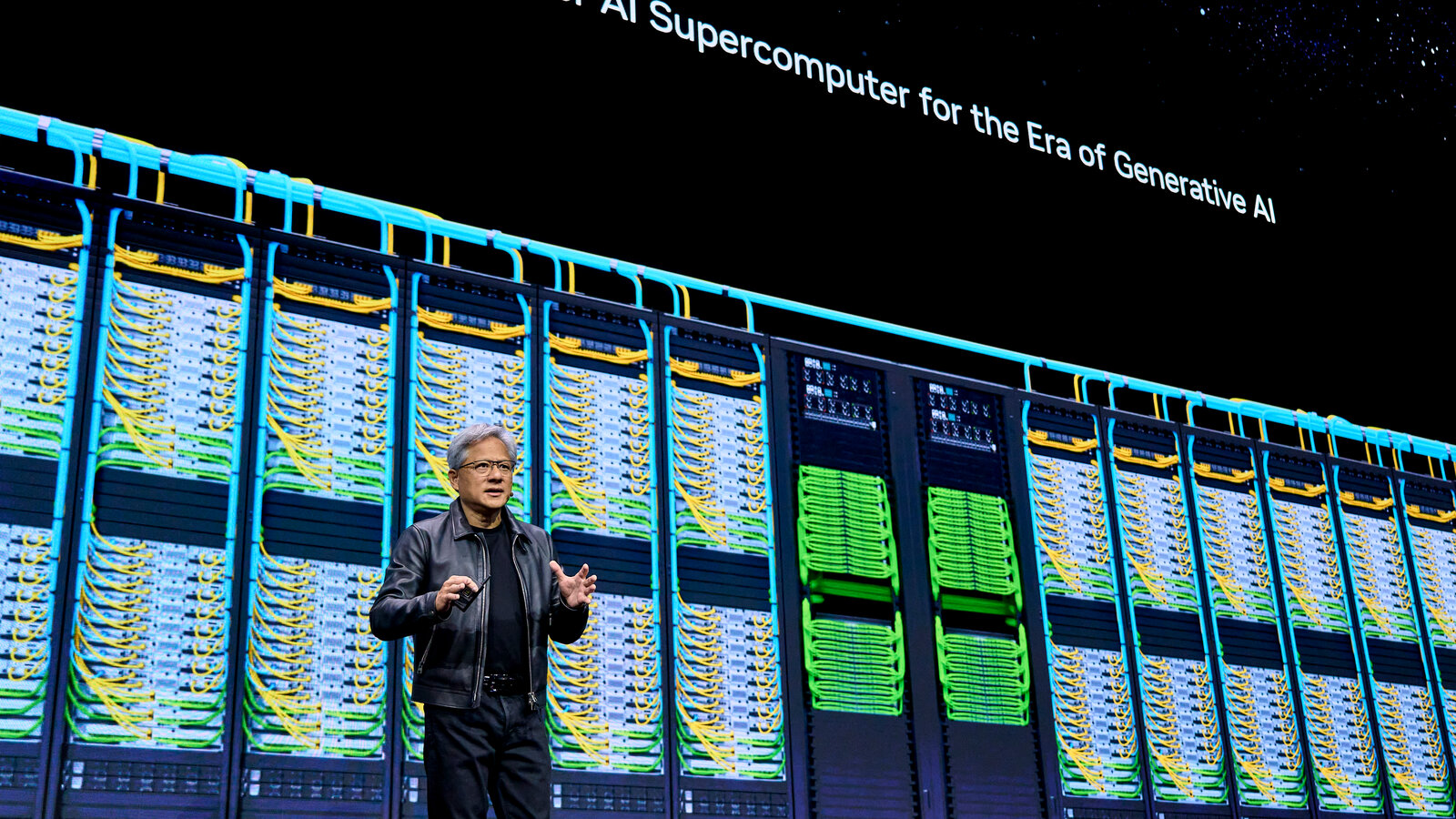

Blackwell Chips and Market Dominance

Nvidia reportedly controls approximately 90% of the AI chip market, a commanding position that few companies in any industry can claim. The company’s newest Blackwell processors have been particularly successful, with $11 billion worth sold in their initial quarter on the market. Despite production constraints, demand continues to exceed supply as companies race to secure computing power for their AI initiatives. CEO Jensen Huang stated that “Blackwell sales are off the charts, and cloud GPUs are sold out”, highlighting the unprecedented market appetite for Nvidia’s technology.

The company has positioned itself strategically for sustained growth by securing manufacturing capacity. Nvidia reportedly secured 60% of Taiwan Semiconductor Manufacturing Company’s expanded advanced chip packaging capacity for its production needs. This manufacturing partnership enables Nvidia to convert its massive order backlog into delivered products at scale. The company’s executives have expressed confidence in continued expansion, projecting that data center capital spending will reach between $3 trillion and $4 trillion annually by the end of the decade.

Future Outlook and Industry Impact

Nvidia’s leadership sees AI infrastructure as becoming as fundamental as electricity or the internet. CEO Jensen Huang stated that “countries around the world are recognising AI as essential infrastructure — just like electricity and the internet — and Nvidia stands at the centre of this profound transformation”. The company anticipates significant growth ahead, with visibility into approximately $500 billion in spending on its most advanced chips over the next 14 months. This confidence is reflected in major strategic investments, including deals with companies like Anthropic, OpenAI, and xAI worth billions of dollars.

However, challenges remain on the horizon. Geopolitical tensions, particularly regarding chip exports to China, have created uncertainty. US export restrictions significantly impacted Nvidia’s H20 chip sales in the Chinese market, forcing the company to take a $4.5 billion charge. Despite these headwinds, the company continues to innovate and expand its ecosystem across multiple sectors, including gaming, automotive technology, and professional visualization. Competition from cloud providers developing their own AI processors and concerns about potential AI investment bubbles haven’t yet dampened the extraordinary momentum driving Nvidia’s financial performance.