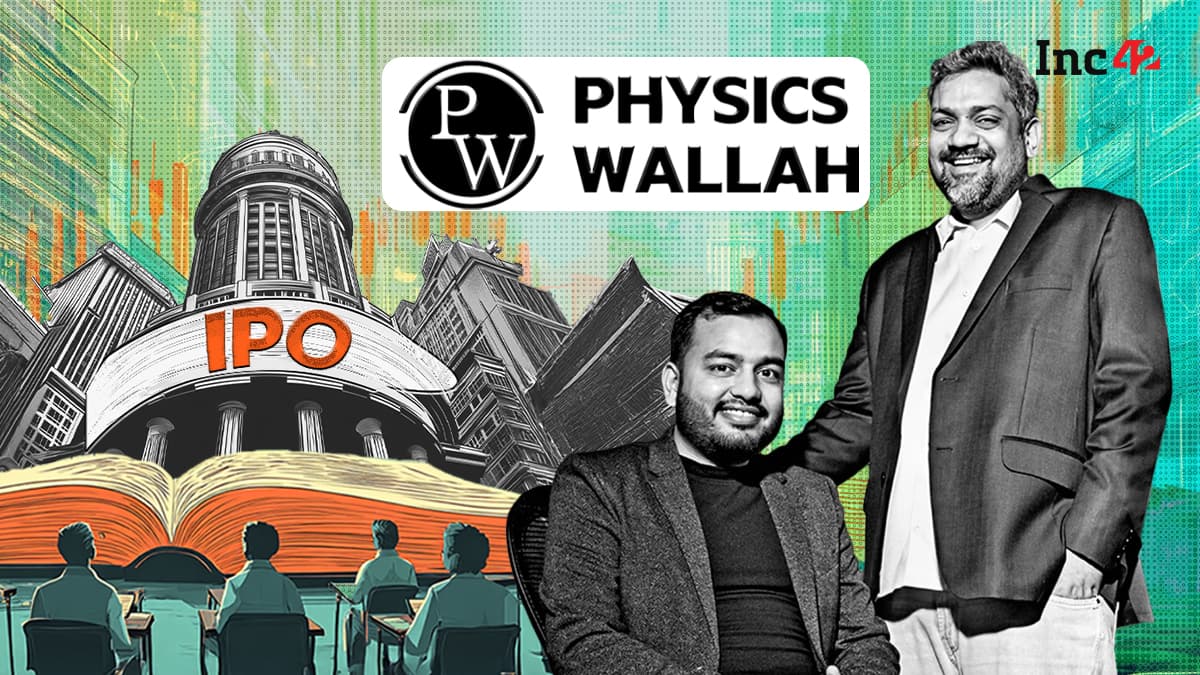

Physics Wallah had a strong IPO debut, going against the overall slowdown in India’s edtech sector

Physics Wallah ended its first day as a public company with shares closing 44% higher than the IPO price

Physics Wallah ended its first day as a public company with shares closing 44% higher than the IPO price at ₹156.49, reaching a peak of ₹161.99 and valuing the company at approximately $5 billion. This remarkable performance stands in stark contrast to India’s struggling edtech sector, where former giants face severe challenges. The company raised ₹34.8 billion (~$393 million) in the IPO, with ₹31 billion from fresh shares and ₹3.8 billion from a secondary sale by co-founders Alakh Pandey and Prateek Boob, achieving a valuation 79% higher than its $2.8 billion private valuation from September 2024. Physics Wallah became India’s first pure-play edtech company to go public, marking a historic milestone at a time when competitors like Byju’s face insolvency proceedings and Unacademy is reportedly considering acquisition at a fraction of its former valuation.

From YouTube Channel to Public Company Success

Founded in 2016 as a YouTube channel with just $340 by teacher Alakh Pandey, Physics Wallah has grown into a comprehensive education platform serving India’s tier-2 and tier-3 cities with digital courses, physical centers, and hybrid programs. In financial year 2025, the company reported revenue increasing 49% to ₹28.9 billion from the previous year, while net loss narrowed dramatically to ₹2.4 billion from ₹11.31 billion, demonstrating a clear path toward profitability. The company reported 4.5 million paying subscribers, a 23% increase from the prior year, with online channels accounting for 48.6% of operating revenue and offline centers contributing 46.8%. This balanced approach between digital and physical presence has proven crucial to Physics Wallah’s resilience in a market where pure online players have struggled.

Strategic Expansion Plans Drive Growth Vision

Physics Wallah plans to deploy IPO proceeds primarily toward expanding offline centers, allocating ₹400 crore for new locations with targets of opening at least 70 centers annually over the next three years, plus another ₹400 crore for existing center operations. The company currently operates 303 centers across 152 cities in India and the Middle East as of June 2025, up from 182 centers the previous year, demonstrating aggressive physical expansion. Additional investments include approximately ₹700 crore toward branding and event marketing, ₹200 crore for technology upgrades and server costs, with remaining funds allocated for potential acquisitions and general operations. The expansion strategy focuses on penetrating Karnataka, Kerala, Tamil Nadu, Gujarat, Odisha, and Northeast India, building on the company’s strong presence in tier-2 and tier-3 cities where affordable education remains in high demand.

Signaling Potential Edtech Sector Revival

Physics Wallah’s strong debut contrasts sharply with the broader Indian edtech slowdown, where Byju’s, once valued at $22 billion, faces insolvency proceedings and severe cash issues, while Unacademy is reportedly in talks for a $300-400 million fire sale to UpGrad—a steep decline from its $3.44 billion valuation. The IPO saw solid demand with 1.8 times oversubscription, receiving bids for more than 33.6 crore shares against an offer size of about 18.6 crore shares, signaling that the market still believes in selective, profitable players in the sector. Industry experts suggest that while Physics Wallah’s initially muted subscription signals broader caution for India’s edtech sector, the strong listing performance demonstrates that disciplined, customer-focused business models can still thrive, with more edtech companies like Imarticus Learning, Upgrad, and Eruditus now eyeing the IPO route. The company’s success offers hope that India’s edtech industry may be turning a corner after years of challenges, provided companies maintain focus on unit economics and sustainable growth rather than aggressive expansion.