Nvidia’s AI expansion: spotlight on its key startup investments

Nvidia has dramatically accelerated its venture activity, participating in nearly 67 deals in 2025, surpassing the 54 deals completed

Nvidia has dramatically accelerated its venture activity, participating in nearly 67 deals in 2025, surpassing the 54 deals completed in all of 2024 The semiconductor giant’s investment strategy targets the entire AI ecosystem, from foundational model developers to infrastructure providers and enterprise applications. Major investments include up to $100 billion in OpenAI for AI data center deployment, a $10 billion commitment to Anthropic, and a $2.3 billion round in coding assistant Cursor The company has also backed xAI with plans to invest up to $2 billion, along with significant positions in Mistral AI, Cohere, Perplexity, and CoreWeave. This comprehensive approach allows Nvidia to strengthen relationships with customers while expanding demand for its GPU hardware across multiple AI application domains.

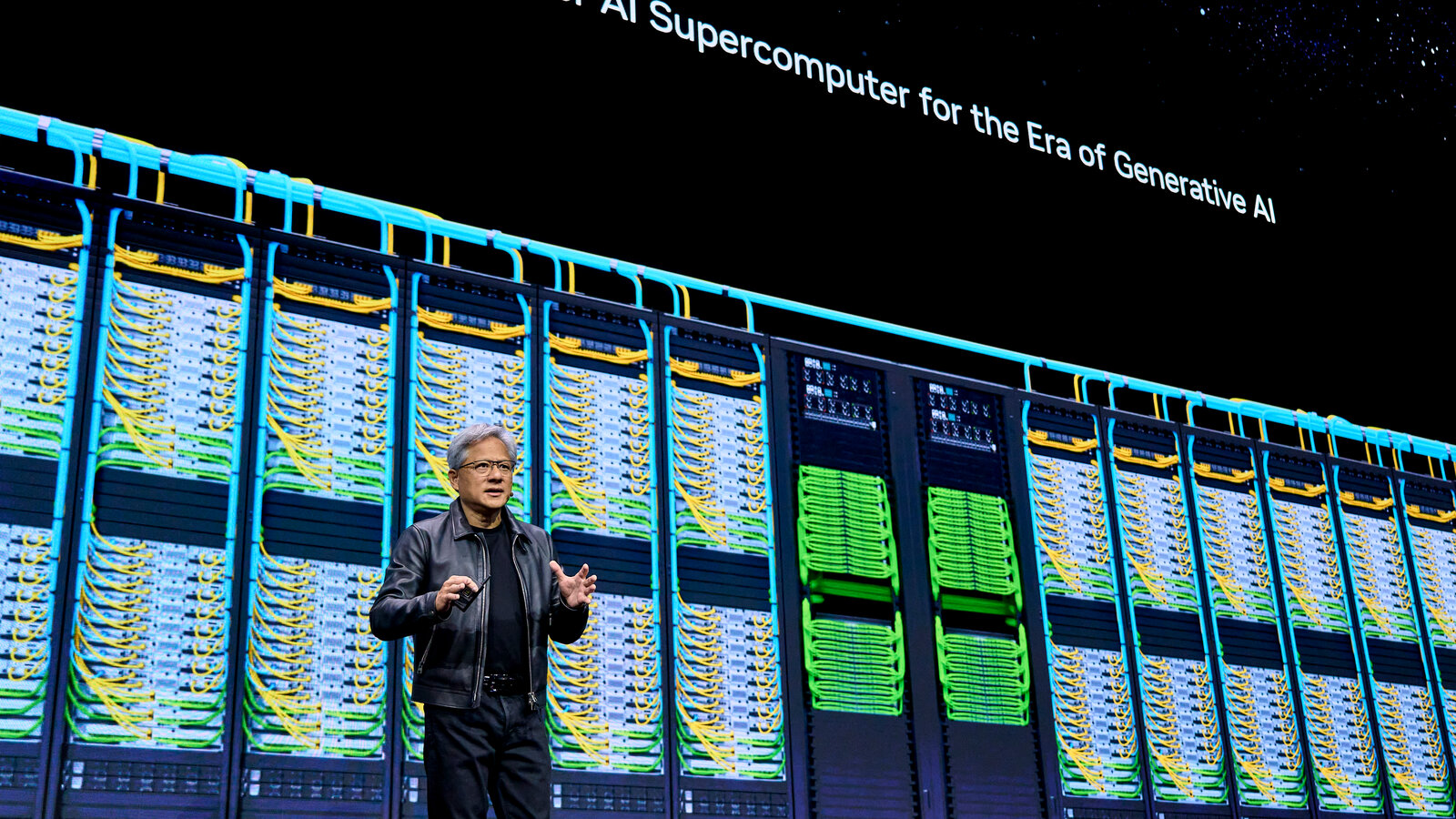

Infrastructure and Hardware Ecosystem Expansion

Beyond software investments, Nvidia has made strategic moves to bolster AI infrastructure capabilities. The company’s most significant deal came in December 2024 when it agreed to acquire assets from AI chip designer Groq for approximately $20 billion , representing Nvidia’s largest acquisition ever and dwarfing its previous $7 billion purchase of Mellanox in 2019. The company has invested heavily in data center infrastructure providers like Crusoe and CoreWeave, which are building specialized computing facilities for AI workloads. Nvidia has also backed startups in autonomous systems including Wayve for self-driving technology, Figure AI for humanoid robotics, and Nuro for autonomous delivery vehicles. These investments position Nvidia to capture value across the entire computing infrastructure stack as enterprises scale their AI operations.

Building Market Dominance Through Strategic Capital Deployment

Nvidia invested approximately $1 billion across 50 startup funding rounds in 2024, up 15% from $872 million across 39 rounds in 2023 The company’s stated goal is to expand the AI ecosystem by backing what it calls game changers and market makers. This aggressive investment strategy serves multiple purposes: securing long-term customers for Nvidia’s GPU products, gaining early visibility into emerging AI applications, and creating a network effect where portfolio companies drive demand for each other’s services. While regulatory scrutiny has increased around Nvidia’s market dominance and investment practices, the company maintains that it competes on merit and that investments are independent of infrastructure requirements. As the AI market is projected to grow from $600 billion in 2025 to $3-4 trillion by 2030, Nvidia’s strategic positioning through venture investments could amplify its already substantial market advantage.